How State-Level Laws Are Shaping the Future of Alternative Finance

One month ago in Nexi Insider, we covered how brokers can stay ahead of tightening regulations. Now, the wave is growing.

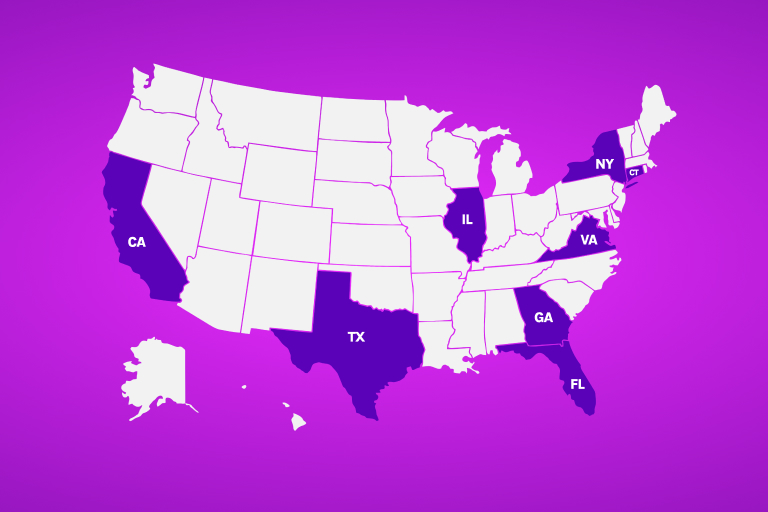

A recent map shared by Sean Murray, Chief Editor of deBanked, illustrates how far state-level disclosure laws are spreading. What began with New York, California, and Connecticut is no longer isolated. States like Florida, Georgia, Illinois, Virginia, and now Texas are following suit.

👉 The pressure for transparency is quickly becoming a national standard.

🌍 A Snapshot of State-Level MCA Regulations

(And What It Means for Brokers)

🌴 Florida enacted the Florida Commercial Financing Disclosure Law (FCFDL) It requires full, consumer-style disclosures covering total financing amounts, disbursement and fees, repayment schedules, and prepayment policies. Brokers must also adhere to advertising and fee regulations

🇮🇱 Illinois mandates clarity on fees, APR equivalents, and default terms in MCA contracts—raising the transparency bar.

🇻🇦 Virginia enforces provider and broker registration, standardized disclosures, and formal dispute procedures.

🇺🇸 Texas (Under House Bill 700/SB 2677)

Signed into law on June 20, 2025; effective September 1, 2025

- Requires broker registration with the Office of Consumer Credit Commissioner

- Introduces consumer-style disclosures for all commercial financing (advance amount, finance charges, repayment plan, broker compensation)

- Prohibits automatic bank debits unless the provider holds a perfected, first-priority lien on the account

🌊 Why the Rise in Regulation?

The MCA space has exploded over the last decade. But with growth came inconsistency—unclear terms, unpredictable payment structures, and a widening trust gap between merchants, brokers, and funders.

Regulators took notice.

Today, more states are stepping in to demand:

- 🔎 Clear disclosures on costs, rates, and terms

- ✅ Easy-to-understand repayment obligations

- 🚫 Better guardrails against misleading offers

And for good reason: merchants deserve to know what they’re signing up for.

🤝 Why It Matters for Brokers

Brokers who ignore this shift risk being left behind—or worse, losing credibility with merchants.

But those who lean in?

They’re building something better.

- 💬 Clarity builds trust

- 📚 Education builds long-term relationships

- 👥 Transparency strengthens your reputation

As these laws take hold, it’s no longer about how fast you can fund a deal. It’s about how well you can explain it—and how confidently your merchants can say “yes.”

🔍 The Role of Brokers in the New Era

Brokers now play a critical role in helping merchants make informed decisions, not just fast ones.

That means:

- 📝 Using clear, easy-to-digest offers

- 💵 Explaining total payback, not just advance amounts

- 🔄 Guiding merchants to funding structures that reduce—not increase—debt pressure

This isn’t just about compliance. It’s about leadership.

🧭 Where Nexi Stands

At Nexi, we’ve always believed in funding with integrity.

That’s why:

- We prioritize clarity in every deal

- We partner closely with brokers to ensure merchants fully understand their terms

- We offer funding options—like our Reverse Consolidation Weekly Purchase Program—that are built for stability, predictability, and long-term relief, not just short-term wins

- We stay ahead of evolving regulations, ensuring every deal aligns with today’s compliance standards

✅ In a tightening regulatory environment, brokers need to align with funders who lead with compliance, transparency, and ethics. As state-level laws expand, choosing proactive partners (not reactive) can make all the difference.

💬 “It’s always better to be upfront about what merchants can realistically expect. This helps avoid disappointment and builds long-term relationships based on trust and honesty.”

— Angie Marks, Director of ISO Relations at Nexi

📬 Missed Our First Newsletter on Regulation?

Catch up here: The Regulatory Tightening in Alternative Finance – Nexi Insider

🔚 Final Takeaway

Transparency isn’t a trend; it’s the future.

And it’s coming to every state, every broker, and every funder.

Brokers who embrace this shift and partner with funders who value clarity and trust over transaction speed will be the ones who lead.

Let’s be those brokers.

Let’s grow forward—together.

👉 Let’s talk.

📞 1-800-499-NEXI (6394)

📅 Book a call with our ISO Relations Team

💼 Register as a New ISO/Broker

📬 Subscribe to Nexi Insider on LinkedIn