The Starting Point of the Regulation Ripple

When New York passed its Commercial Financing Disclosure Law (CFDL) in 2021, it didn’t just change the game — it defined it.

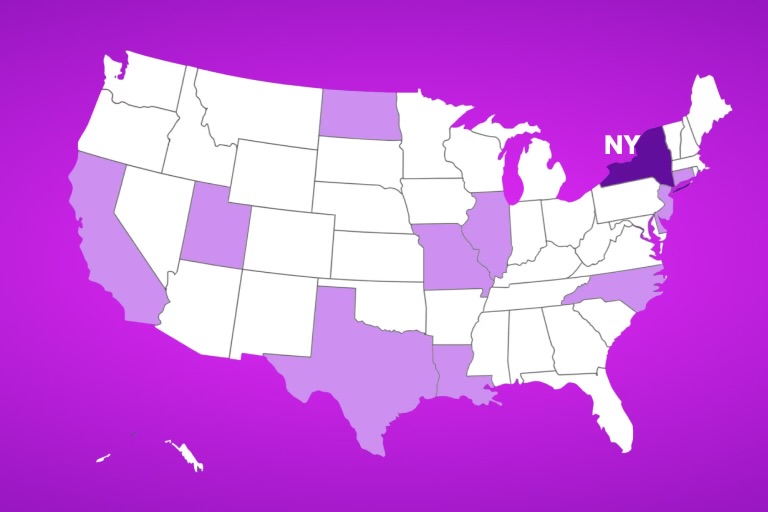

What began as a push for transparency among SMBs has since become the blueprint for MCA regulation nationwide. From California and New York to Connecticut and Texas, the ripple continues to spread. Now, states such as North Dakota, Louisiana, Illinois, New Jersey, North Carolina, Missouri, and Utah are joining the wave, introducing new disclosure, registration, and collection laws that are reshaping how alternative financing operates nationwide.

And while others are still catching up, New York remains the most tested and closely watched regulatory environment in alternative finance today.

⚖️ What the New York Disclosure Law Requires

Under the CFDL, commercial financing providers, including merchant cash advances (MCAs), factoring, and revenue-based financing, must give New York based merchants standardized, pre-transaction disclosure statements for transactions of $2.5 million or less that clearly outline costs and terms.

These disclosures must clearly outline key terms, include:

- Total financing and funded amounts

- Estimated APR (yes, even for MCAs)

- Total cost of financing, including fees

- Remittance schedule and prepayment policies

- Broker compensation

💡 The goal: empower merchants to compare financing options “apples to apples,” in a market where remittance structures can differ dramatically.

🔍 How It’s Being Enforced

Since the law took effect, the New York Department of Financial Services (DFS) has issued supervisory guidance and begun compliance examinations. Regulators are focusing on:

- Missing or inaccurate disclosures

- Misleading APR representations

- Unregistered brokers soliciting New York merchants

The takeaway? DFS is treating CFDL compliance as a top supervisory priority — and it’s setting a national precedent.

🌊 The Ripple Effect

New York’s CFDL directly influenced:

- California (DFPI) — added stricter broker registration and stronger enforcement authority

- Connecticut & Florida — modeled their disclosure laws on New York’s framework

- Texas (HB 700) — moved beyond disclosure to regulate how MCA remittances are structured and collected

And now, Louisiana has incorporated similar definitions and disclosure requirements into its legislation.

👉 What started in New York is becoming the national standard.

🔑 What Brokers Should Do

This isn’t just compliance — it’s competitive positioning.

Here’s how brokers can stay ahead:

🟩 Consider auditing your contracts with counsel: Review disclosures, broker compensation, remittance terms, and ACH language.

🟩 Review all New York deals: make sure your funders issue compliant disclosure statements.

🟩 Lean into MCA transparency: Clear terms and plain-language explanations are now a competitive advantage.

🟩 Keep documentation organized: DFS enforcement may begin with requests for records and audit trails.

🟩 Align with compliance-forward funders: the right partnerships minimize risk and maximize credibility.

⚠️ The Real Issue Isn’t MCAs — It’s Misuse

When used responsibly, MCAs are powerful, flexible tools that help merchants thrive.

The challenge isn’t the product — it’s when some brokers:

- Overextend merchants with multiple stacked advances

- Weigh them down with daily remittances

- Disappear after receiving their commission

Regulation aims to fix the behavior, not eliminate the funding option.

🧱 Where Nexi Stands

At Nexi, we operate on one principle: trust builds long term success

👉 Read our full blog article here

That’s why we offer:

✅ Transparent, plain-language, compliant deal terms

✅ A Reverse Consolidation weekly purchase program that helps merchants simplify and reduce stacked MCA remittances

✅ A compliance-forward approach that helps brokers minimize risk, stand out as true partners, and build sustainable, long-term relationships

🔚 Final Thought

New York may have started the ripple, but the current is only getting stronger. The next wave of MCA regulation will reward brokers who lead with transparency, trust, and accountability.

Ready to work with a partner who’s already built for the future?

👉 Let’s talk.

📞 1-800-499-NEXI (6394)

📅 Book a call with our ISO Relations Team (https://hubs.li/Q02Dczv00)

💼 Register as a New ISO/Broker (https://hubs.li/Q02DczSk0)

📬 Subscribe to Nexi Insider on LinkedIn— Industry trends. Regulation updates (https://lnkd.in/gX2j2enM)

Disclaimer: This newsletter is provided for informational purposes only and does not constitute legal advice. Readers should consult their own counsel before taking any action based on the information herein.