While Florida isn’t the latest development, it’s still another stop in the broader national progression toward greater MCA transparency and accountability.

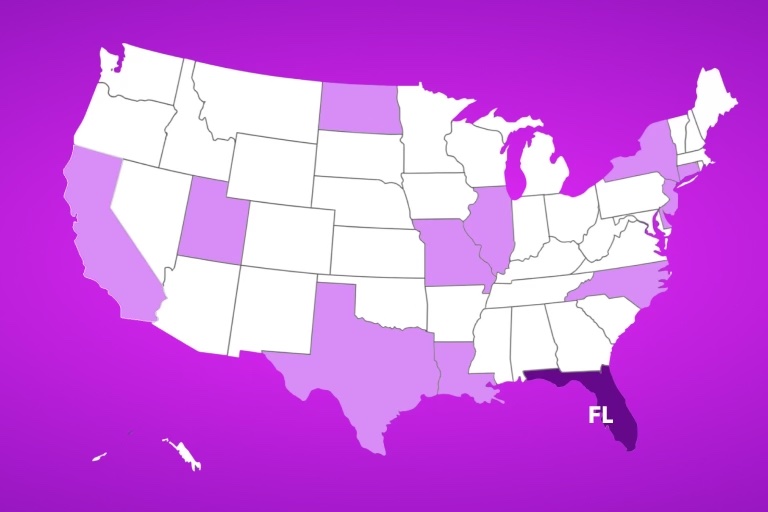

Regulation in the alternative finance space has expanded steadily over the past several years. It began with New York laying the foundation for standardized disclosures, continued with Texas rewriting the rules for how payments can be legally collected, and was strengthened further with California introducing stricter requirements, mandatory broker registration, and active examinations.

Florida’s Commercial Financing Disclosure Law (CFDL) has been in effect since January 1, 2024. While the law itself is not new, the enforcement expectations are now firmly established, making Florida a key part of the ongoing national regulatory landscape.

Source: Buchalter — Florida Enacts Commercial Financing Disclosure Law

https://www.buchalter.com/insights/florida-enacts-commercial-financing-disclosure-law-mandatory-compliance-date-january-1-2024/

🔎 Florida’s Commercial Financing Disclosure Law: What’s Required

Florida’s CFDL applies to commercial financing transactions of $500,000 or less and mandates consumer-style clarity for small-business borrowers. Providers must now disclose:

- Total amount of funds provided

- Total amount disbursed (after fees)

- Total amount to be paid to the provider under the agreement

- Total cost of financing, including fees

- Payment method and frequency

- Prepayment terms, including whether early payoff affects cost

Source: Winston & Strawn — Florida Enacts Commercial Financing Disclosure Law

https://www.winston.com/en/insights-news/florida-enacts-commercial-financing-disclosure-law-requiring-consumer-style-disclosures-for-certain-commercial-financing-transactions

Florida also introduced a unique broker rule that stands out nationally:

- Brokers may not collect upfront fees for brokerage services

- All advertisements must display a valid physical address and telephone number

Source: deBanked — Florida’s Unique Broker Rule

https://debanked.com/2023/05/florida-set-to-enact-commercial-financing-disclosure-law-with-unique-broker-rule/

These requirements reinforce transparency and establish clearer expectations for brokers operating in Florida.

🌎 Where Florida Fits in the National Regulatory Wave

New York — The starting point

Set the original standard in 2021 with disclosure requirements for transactions up to $2.5 million.

Texas — The turning point

Texas, historically one of the most pro-business and lightly regulated states, has enacted legislation that goes beyond disclosure — rewriting the rules for how payments can be legally collected.

California — The game-changer

Introduced mandatory broker registration, tightened the cap to $500,000, and expanded DFPI supervision — including active examinations.

Florida — One stop in the progression

Florida’s CFDL is already in effect, requiring consumer-style disclosures, banning upfront broker fees, and authorising the Florida Attorney General to enforce compliance.

Source: OnyxIQ — State-by-State Disclosure Laws

https://onyxiq.com/commercial-financing-disclosure-laws/

The pattern is clear:

States are moving from disclosure → oversight → enforcement.

🔑 What Brokers Should Do Now

🟩 Review all Florida deals: make sure your funders are issuing compliant disclosure statements.

🟩 Lean into MCA transparency: Clear terms and plain-language explanations are now a competitive advantage.

🟩 Keep documentation organised: The Florida Attorney General has exclusive enforcement authority and may request records or initiate actions based on complaints.

🟩 Align with compliance-forward funders: the right partnerships minimise risk and maximise credibility.

🧱 Where Nexi Stands

At Nexi, we operate on one principle: trust builds long-term success.

That’s why we offer:

✅ Transparent, plain-language, compliant deal terms

✅ A Reverse Consolidation weekly purchase program that helps merchants manage and lower the strain of stacked MCA remittances

✅ A compliance-forward approach that helps brokers minimise risk, stand out as true partners, and build sustainable, long-term relationships

✅ Guaranteed commission payout within 24 hours of funding.

✅ Guidance and resources to help partners stay compliant in Florida and beyond

🔚 Final Thought

The regulatory wave began in New York,

shifted in Texas,

strengthened in California,

and includes Florida as part of the broader national progression.

As more states move toward clearer disclosures and stronger oversight, the brokers who lead with transparency and compliance will define the future of alternative finance.

Ready to stay ahead of compliance and support your merchants with a partner built for what’s next?

👉Let’s talk.

📞 1-800-499-NEXI (6394)

📅 Book a call with our ISO Relations Team: https://hubs.li/Q02Dczv00

💼 Register as a New ISO/Broker: https://hubs.li/Q02DczSk0

Disclaimer: This article is provided for informational purposes only and does not constitute legal advice. Readers should consult their own counsel before taking any action based on the information herein.er registration requirements and enforcement oversight