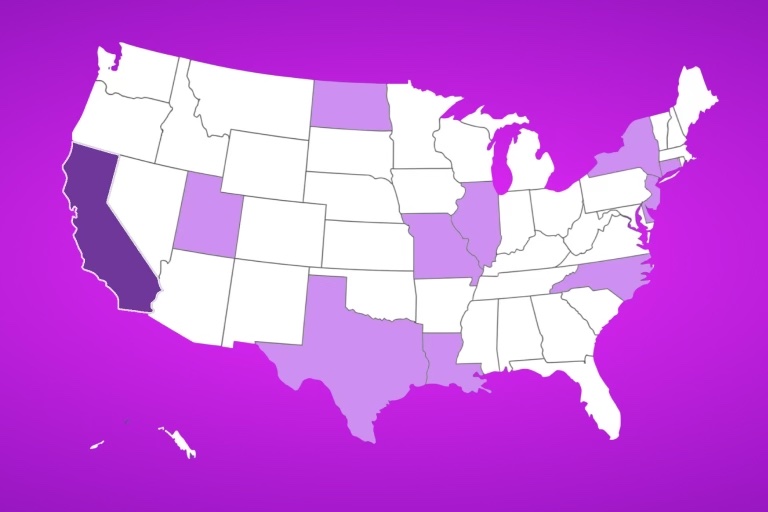

From New York to California — how the regulatory wave is reshaping alternative finance

When New York set the stage for MCA regulation, California wasn’t far behind. Enacted in 2018 and implemented in December 2022, the DFPI began enforcing its Commercial Financing Disclosure Law (CFDL) — a landmark regulation that introduced standardised pre-transaction disclosures to one of the nation’s largest small-business markets, and sets the stage for future rules that would introduce broker registration requirements and enforcement oversight.

This West Coast version of disclosure mirrors much of New York’s approach but adds unique complexities in how Estimated APR calculations are defined, reported, and enforced.

In this issue of Nexi Insider, we explore how California’s rules differ, how enforcement is unfolding, and what brokers can do to stay compliant and competitive.

⚖️ What California’s Disclosure Law Requires

Under California’s CFDL, providers of commercial financing — including merchant cash advances, factoring, and revenue-based financing — must deliver standardized, pre-transaction disclosure statements to California-based small businesses for transactions up to $500,000. Morrison Foerster +3Loeb

Each disclosure must clearly include:

- Estimated APR (calculated under DFPI-defined methods for sales-based financing and factoring)

- Total cost of financing, including all fees

- Payment frequency and estimated term

- Broker compensation and any related fees

- Prepayment policies and conditions

💡 The goal: Give small-business owners the ability to compare MCA offers “apples to apples,” even when the underlying remittance structures differ widely.

🔍 How It’s Being Enforced

The DFPI has taken an active supervisory role, issuing guidance, FAQs, and examination requests to verify that disclosures meet its formatting and content standards. Morrison Foerster+2Manatt Phelps & Phillips+2

The early examinations have focused on:

- Inaccurate or missing Estimated APR calculations, IFA Commercial Factor+1

- Unregistered brokers soliciting California merchants Manatt Phelps & Phillips+1

- Use of non-compliant disclosure forms or outdated templates Loeb+1

The DFPI has also begun requiring broker registration, creating a public record of licensed entities, and facilitating commercial financing. Mayer Brown+1

Like New York’s DFS, California’s regulators are signaling that CFDL compliance is now a priority exam item, not a voluntary best practice.

🌎 How California Compares to New York

While both New York and California share the same goal — increasing transparency and accountability in merchant cash advance regulation and commercial financing — their paths diverge in important ways.

New York’s Commercial Financing Disclosure Law (CFDL) set the framework in 2021, covering transactions up to $2.5 million or less and focusing primarily on standardized pre-transaction disclosures. California followed with its own version in 2022, tightening the lens to deals up to $500,000 and expanding regulatory oversight through the Department of Financial Protection and Innovation (DFPI).

Unlike New York, California’s rules require brokers to be formally registered with the DFPI — creating a state-level licensing structure that adds another layer of oversight to how ISOs and funders operate. It also introduced a more intricate APR disclosure formula, specifically designed to capture the variability in merchant cash advance and factoring transactions.

In short:

- New York set the standard.

- California strengthened it.

And while both states aim to protect merchants through transparency, California’s emphasis on registration, data submission, and enforcement power suggests that regulators are moving from disclosure to accountability.

The result is a growing alignment between the two states — but with California shaping the next evolution of what MCA compliance will look like nationwide. Loeb & Loeb LLP, Manatt Phelps & Phillips LLP, MoFo)

🔑 What Brokers Should Do

This isn’t just compliance — it’s competitive positioning.

Here’s how brokers can stay ahead:

🟩 Consider auditing your contracts with counsel: Review disclosures, broker compensation, remittance terms, and ACH language.

🟩 Review all California deals: make sure your funders issue compliant disclosure statements.

🟩 Lean into MCA transparency: Clear terms and plain-language explanations are now a competitive advantage.

🟩 Keep documentation organized: DFPI enforcement may begin with requests for records and audit trails.

🟩 Align with compliance-forward funders: the right partnerships minimize risk and maximize credibility.

⚠️ The Real Issue Isn’t MCAs — It’s Misuse

When used responsibly, MCAs are powerful, flexible tools that help merchants thrive.

The challenge isn’t the product — it’s when some brokers:

- Overextend merchants with multiple stacked advances

- Weigh them down with daily remittances

- Disappear after receiving their commission

Regulation aims to fix the behavior, not eliminate the funding option.

🧱 Where Nexi Stands

At Nexi, we operate on one principle: trust builds long-term success.

That’s why we offer:

✅ Transparent, plain-language, compliant deal terms

✅ A Reverse Consolidation weekly purchase program that helps merchants simplify and reduce stacked MCA remittances

✅ A compliance-forward approach that helps brokers minimize risk, stand out as true partners, and build sustainable, long-term relationships

✅ Guaranteed commission payout within 24 hours of funding.

✅ Guidance and resources to help partners stay compliant in California and beyond

🔚 Final Thought

New York started the ripple.

California turned it into a wave.

And as more states move to regulate MCA disclosures, the brokers who lead with transparency, trust, and accountability will define the future of alternative finance.

Ready to work with a partner built for what’s next?

👉 Let’s talk.

📞 1-800-499-NEXI (6394)

📅 Book a call with our ISO Relations Team

💼 Register as a New ISO/Broker

📬 Subscribe to Nexi Insider on LinkedIn — Industry trends. Regulation updates.

https://lnkd.in/gX2j2enM

Disclaimer: This newsletter is provided for informational purposes only and does not constitute legal advice. Readers should consult their own counsel before taking any action based on the information herein.er registration requirements and enforcement oversight.